Union Bank

Customer focused and user centered financial services. Designed to help make managing finances easy.

Project Details

- Industry: Financial Services

- Role: User Experience Design

- Company: Publicis Sapient

- Client: Union Bank

- Date: 2019

Quick Facts

- PurePoint Financial, a subsidiary of Union Bank, is wholly owned by MUFG Bank (MUFG Bank, Ltd.), the largest bank in Japan.

- The company specializes in offering high-yield savings accounts and certificates of deposit (CDs).

- MUFG is the 5th largest financial group in the world with total assets of over $2.7 trillion

- 150-year history of serving clients in the United States

PurePoint Financial, a subsidiary of Union Bank, initiated a project to update explore a new type of checking account that would be geared around personal finance and building healthy financial habits. This checking account would integrate with an artificial intelligence engine to enhance user experience in managing their finances. The project scope encompassed the entire customer journey, beginning after the initial account opening and funding process.

Process

- Research and Strategy : – Engaged in client workshops to help focus overall vision for the product. Conducted research on best practices, industry landscape, and then presented designs to our internal team and gathered feedback.

- Holistic Design Audit : – Reviewed current brand guidelines such as colors, font, logos, and already existing user interface components.

- Prototype : – Created different design variations across different viewport sizes (mobile, tablet, and desktop). Reviewed with internal team and handed off to visual design.

- User Testing : – Identified use case scenarios that used predictive analytics for future, past, and present transactions that were designed in a prototype for user testing. Worked with our strategy lead to refine designs, collect and synthesize feedback from focus groups.

Key Challenges

- Integrating AI capabilities

- Identifying and analyzing specific user scenarios and key variables to optimize the overall user experience and inform design decisions

- Maintaining a fast-paced development cycle while ensuring quality

- Coordinating between UX, visual design, and usability testing teams

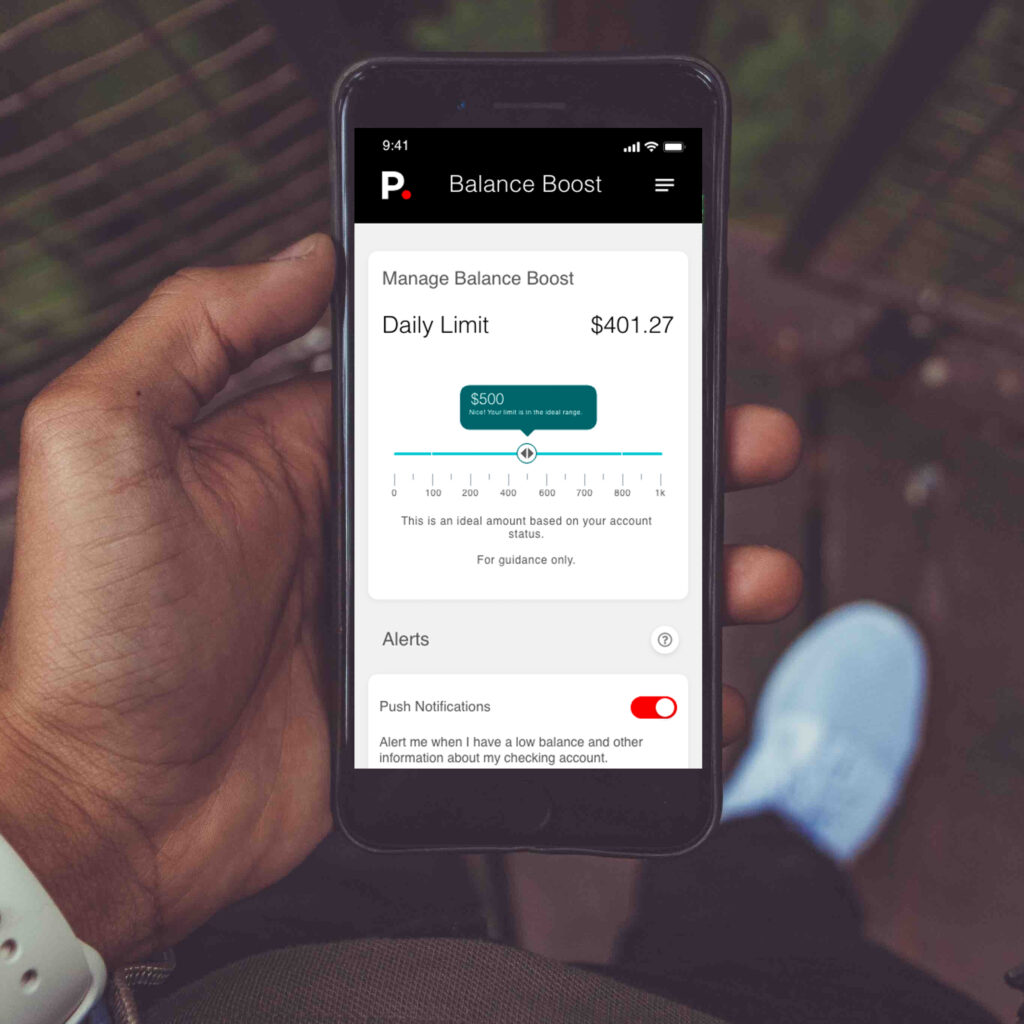

Prototypes

To validate the usability of the Balance Boost concept we created a prototype to evaluate if users were able to understand the information and design. Additionally other insights were created that would be able to help users better manage their finances.

Conclusion

This case study demonstrates PurePoint Financial’s commitment to enhancing their digital offerings through AI integration and user-centered design. The agile approach allowed for user testing and validating design decisions for our client, ensuring that the final product would meet the needs of their customers in managing their accounts. The outcome was a functional and effective design experience that was understood by our focus groups consisting of multiple different user personas.